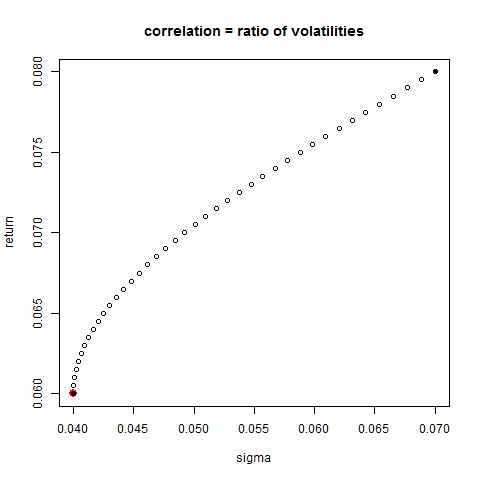

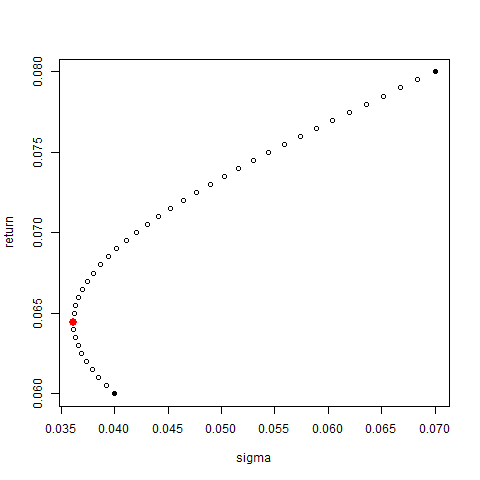

Finding the #MinimumRisk #portfolio on a two-security #EfficientFrontier

In the #Markowitz risk-return space, there is always a portfolio which #MinimizesVolatility. In recent years this allocation scheme has become increasingly popular as the risk free rate hovers near (or below) zero.

For a portfolio of two securities, there is an analytic solution which allocates capital to both securities to minimize the portfolio volatility. We minimize the variance of the portfolio (which is equivalent to minimizing the volatility) by finding the minimum for

where w and (1-w) are the allocations, and

are the volatilities of the two securities and

is the correlation of the returns.

By solving for the first derivative with respect to w equal to zero,

we get

We note the following

- the returns of the securities do not enter into the allocations across the two securities

- the higher the correlation, the greater the weight allocated to the lower-volatility security

If we assume >

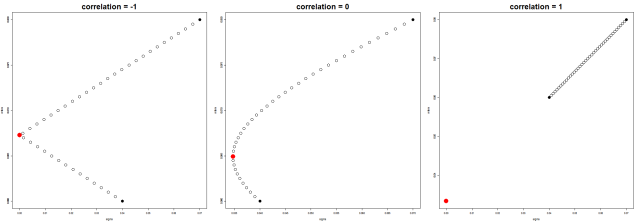

, then we can consider the special cases where

The less volatility security (#1) always receives the greater allocation. When the correlation is -1, the minimum volatility portfolio allocates to both securities. As the correlation increases, the allocation to the less volatile security increases.

When the less volatile security receives the full allocation. Higher values of

create a portfolio with of a leveraged allocation to the less volatile security and a short position in the more volatile security.